-

Technology

-

Geoprime®

Geoprime is the secret recipe for reducing CO2 emissions. Learn more

Familiarise yourself with Geoprime®

View a video

View a video

-

Geoprime®

-

Solutions

Construction

I want to reduce the CO2 footprint of hollow-core slabs and other construction products

.jpg) Discover

Discover

Concrete products

I want to reduce the CO2 footprint of my landscaping and infrastructure concrete products

_lr.jpg) Discover

Discover

- Sustainability

-

News & cases

-

Releases

Press releases, company releases and management transactions

-

Blog

Quality articles and industry events

-

Reference cases

Success cases from our customers

-

Releases

-

Company

-

About us

Learn more about our story and Betolarians

-

Careers

Interested in working at Betolar?

-

Become a partner

Become one of our trusted partners

-

Contact information

Fill a form to contact us and we'll get back to you

Betolar careers

Want to join our team?

Reckon you are just the forward thinking professional we are looking for? Let us know about you!

Check available job positions

Check available job positions

-

About us

-

Investors

- Overview

- Investor relations

- Capital Markets Day 2025

- Investor calendar

- Reports and presentations

- IPO

Interim report

Financial Statements Review 1-12/2024

Check the webcast recording of our Financial Statements Review

View webcast

View webcast

Markets

The green construction market is growing

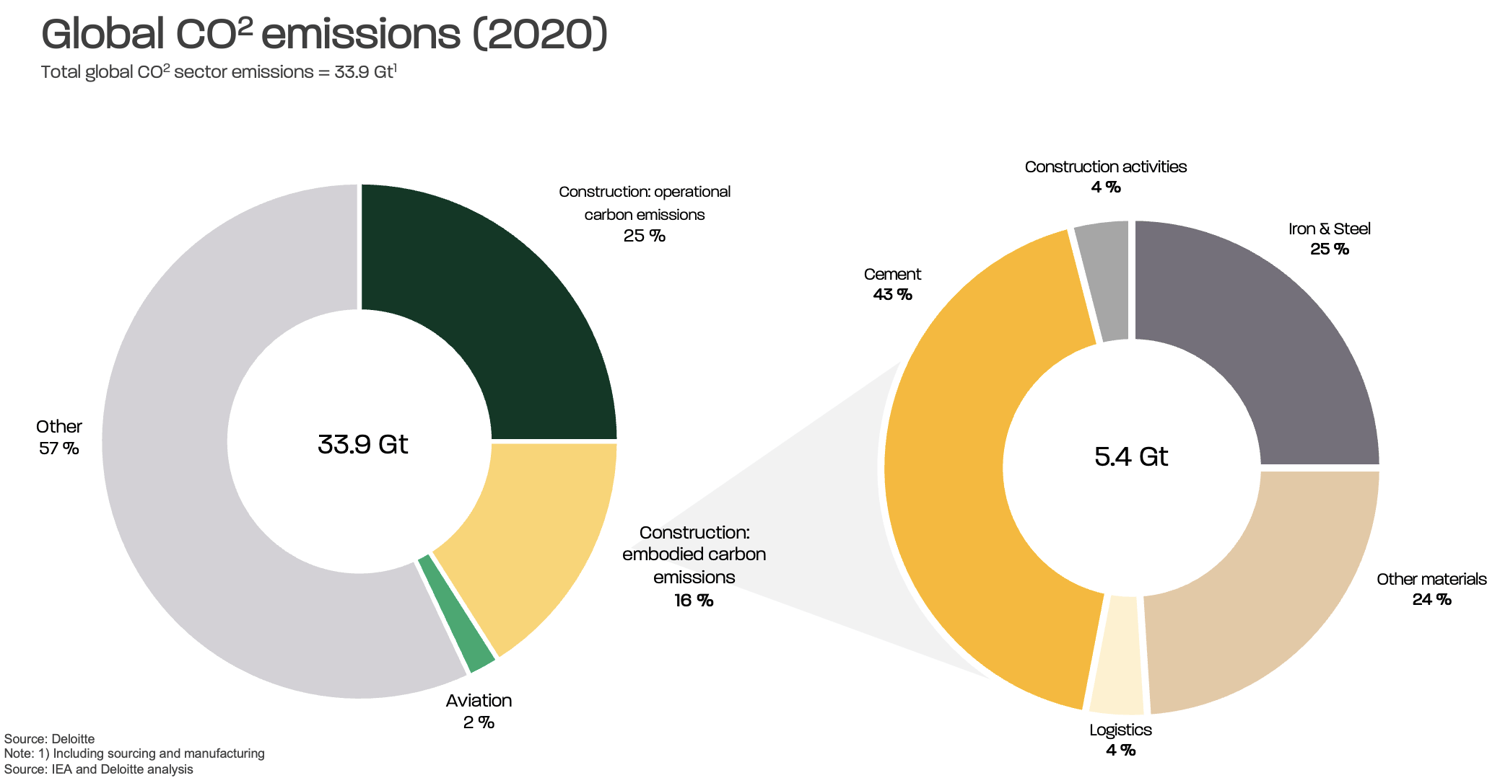

The construction sector accounts for 37% of global carbon emissions, of which 16% represents embodied carbon mainly from material manufacturing.

According to Deloitte's market study, most sector emissions (92%) are driven by the manufacturing and sourcing of materials. This is due to emissions from the chemical processes required to produce materials, the energy intensity of these processes, and the sheer volume of materials required. From an emissions perspective, cement is the largest contributor, followed by iron and steel, and other building materials.

Significant carbon reduction needs decisive action now. In order to successfully address the contribution of buildings GHG emissions, emission reductions need to be made across the sector’s entire value chain.

The green transition in construction is driven by the carbon neutrality targets of the public sector and companies, but also by the sustainable development requirements and investment strategies of financiers.

EUR 1.5 billion

Global market potential for low-carbon cement replacement solutions in 2026.

KPMG market study

4.1 billion tonnes

Global cement production in 2019

Cembureau

Markets

Opening up markets in EMEA and APAC

National climate pledges and sustainable finance schemes will strongly increase the demand for green construction technologies in Betolar's target markets.

The European Union is committed to reducing its climate emissions by 55% by 2030 compared to 1990 levels. The EU's sustainable finance action plan also strengthens the channelling of funding towards green projects.

National building regulations implement the EU's low-carbon objectives in the Member States. The goal is to achieve carbon neutrality in the EU by 2050.

In Asia, Betolar currently operates in the Indian market. Along with China, India is one of Asia's largest cement users and has committed to reducing the carbon intensity of its GDP by 45% by 2030 (compared to 2005 levels). The goal is to achieve carbon neutrality by 2070.

Year 2050

EU pledge to become carbon neutral

Year 2070

India's pledge to become carbon neutral

Competition

The traditional way is our biggest competitor

In Europe, the competitive environment consists mainly of a few companies offering geopolymer solutions and several companies offering blended cements (CEM II-III). In blended cements, part of the cement clinker has been replaced mainly by ground blast furnace slag (GGBFS) or fly ash. This helps to reduce carbon dioxide emissions caused by cement. However, the challenge with blended cements is that the cement clinker can only be replaced by blast furnace slag or ash up to a certain point, after which the performance characteristics of the concrete, such as bonding and strength development rate, are no longer compliant. This limits the applicability of blended cements.

Given the emphasis in Betolar's strategy on other alternative side streams, the reduced availability and increased price of blast furnace slag and fly ash will not have as significant an impact on Betolar's position in terms of raw materials. In addition, the price of activators used in Geoprime has decreased during this year, which improves the competitiveness of the solution.

In Asia, the main competitors are the traditional cement manufacturers. The availability of side streams is a key market driver, and product standards in Asia generally focus on the properties, rather than the raw materials, that create favourable opportunities for non-cementitious binders.